Record to Report

The idea behind the end-to-end (E2E) process concept is to provide a holistic view of business operations, focusing on the complete flow of a specific process from its beginning to its end. This approach aims to enhance efficiency, improve performance, and ensure that every step of the process is aligned with the business’s overall objectives. The key benefits of adopting an E2E perspective include:

Streamlined operations: By eliminating unnecessary steps and focusing on value-added activities, companies can streamline operations, reduce costs, and increase productivity.

Increased transparency: By looking at processes from start to finish, companies can better identify inefficiencies, bottlenecks, and areas for improvement.

Improved collaboration: An E2E approach helps different departments and teams work together, creating a more unified work environment by clearly defining inputs, outputs, and transfer points.

There are multiple end-to-end process that help streamlining activities and improving outcomes, examples are: Plan-to-Perform. Hire-to-Retire, Customer-to-Cash or Campaign-to-Conversion. A specific end-to-end process that is regarded as a Best Practice is the Record-to-Report (R2R) process. This specific process focuses on optimizing streamlining accounting activities that should lead to fast, reliable, compliant and insightful financial reports.

Designing the Record-to-Report process

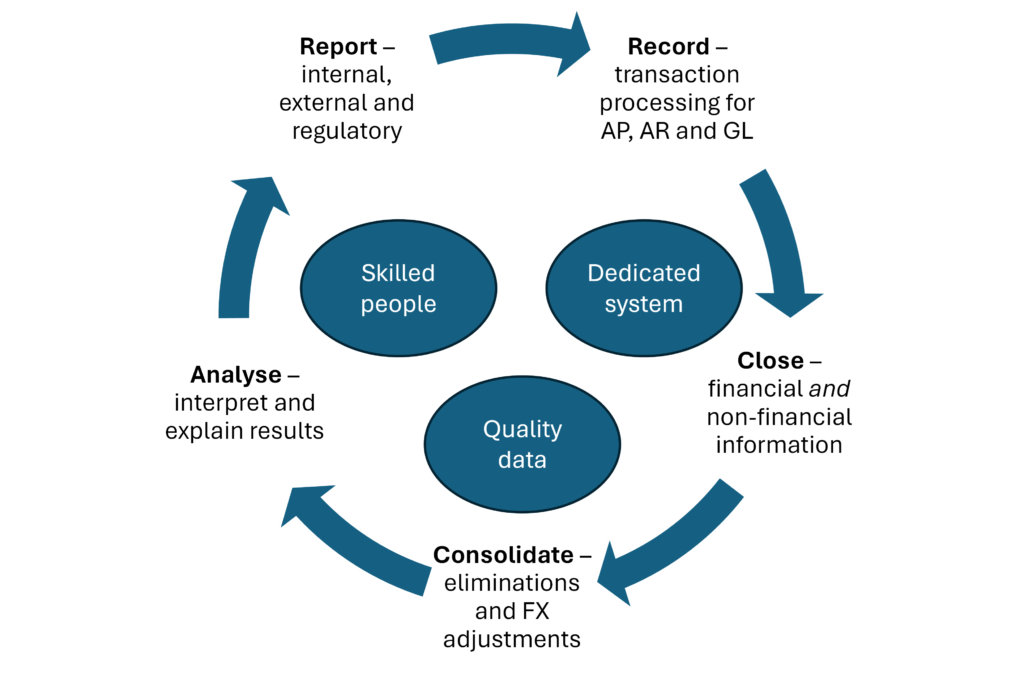

So, what exactly does Record-to-Report entail, and how should companies approach its design and execution? The following 5 steps are the core of a R2R process.

- Make sure all financial transactions are recorded in a modern finance or ERP system. Preferably in a SaaS application that enables connectivity with other software, if applicable. In case of multiple legal entities try to use one Chart of Accounts and similar accounting procedures. Define with the finance team(s) your standards for timely and accurate recording of transactions.

- Define the steps and activities that have to be carried out each month. Make sure all required information is available and updated in such a way that it complies with general accounting rules and company standards. Combine the financial information with selected business KPI’s so that you can reports on ratio’s such as revenue per country, margin per product group or average rate per hour, depending on your business.

- Make sure you have recorded all intercompany revenues and costs on separate accounts in your finance system(s). If any adjustments need to be made, make these changes in the finance system, so you have one data source for all transactions and adjustments.

- Analyse financial results and combine these with your budget or forecast and explain discrepancies between the goals and actual performance and identify reasons and clarifications for these differences.

- Present a compelling combination of data tables, graphs and KPI’s that clearly explains the state of the business. Make sure that there are different formats and levels of detail for internal and external usage.

Requirements for the Record-to-Report process

The journey begins with a solid foundation: skilled individuals. The human element cannot be overstated; expertise is required to understand the nuances of a reliable accounting process and with ability to navigate its complexities.

Next to the right set of skills, a state-of-the-art finance system is essential. This technology acts as the backbone of the R2R process, providing the tools necessary for solid finance operations, analysis, and reporting. With the right system in place, businesses can ensure accuracy, enhance efficiency, and facilitate better decision-making.

However, even the most skilled team and advanced system would falter without one critical ingredient: quality data. Data is the lifeblood of the R2R process. Accurate, timely, and relevant data inputs allow businesses to make informed decisions, adapt to changes, and stay ahead of the curve. Too little, too late or wrong data will frustrate your R2R process, but almost as bad for insightful results is too much data. An overload of operational details may cause extra work to get the numbers updated on a periodic basis and it may create the illusion of being complete, while the additional data does not actually improve accuracy or business insights. So the advice is to keep it to top-level KPIs and tailored financial reports

Conclusion

To conclude, a well-designed and well-executed Record-to-Report process is a vital component for any finance department; requiring skilled people, advanced technology, and high-quality data. By designing and executing this process effectively. You can assess your own financial maturity level with our downloadable best practice guide.

If you wat to sit back and listen to the Smartbooks story and have a short demo of our software, you can watch our recorded webinar by clicking here.