In the world of business intelligence, understanding the right tool for the right job is crucial. Among the myriad options available, FP&A (Financial Planning & Analysis) tools and PowerBI stand out for their specialized capabilities. However, their functions, while distinct, are complementary. This blog post will break down the differences and suggest why both tools are essential for a comprehensive approach to business analytics.

The Specialized Strength of FP&A Tools

FP&A tools are designed with the finance team in mind. Their primary focus is on financial reporting, analysis, planning, and consolidation. What does this mean? Essentially, these tools are built to handle complex financial operations such as budgeting, forecasting, and financial consolidation across multiple entities in various currencies. This specificity allows financial teams to navigate the intricate landscape of company finances with precision, offering functionalities that support detailed financial planning and decision-making.

For instance, when a company operates internationally, dealing with multiple currencies can become a headache. FP&A tools streamline this by automatically converting currencies and consolidating financials, making it easier for companies to get a clear picture of their global financial health. Similarly, these tools excel in budgeting and forecasting by enabling users to input various financial scenarios and see potential outcomes, thereby aiding in strategic planning.

PowerBI: A Master of Operational Data

PowerBI, on the other hand, shines in a different arena. Its strength lies in slicing and dicing operational data. This tool is a powerhouse for creating interactive reports and dashboards that bring data to life. From sales metrics to customer engagement statistics, PowerBI helps users dive deep into operational details, uncover trends, and derive insights that can inform business strategies.

However, where PowerBI excels in operational analysis, it does not natively support the financial planning, budgeting, and consolidation functionalities inherent to FP&A tools. It’s not designed to handle the complexities of financial planning or manage the consolidation of accounts across different entities and currencies.

Better Together

The takeaway? While PowerBI and FP&A tools each have their strengths, they’re not in competition. Instead, they should be viewed as complementary pieces of a larger puzzle. FP&A tools offer the depth of financial insight necessary for strategic planning and financial management, while PowerBI provides a broad view of operational performance and trends.

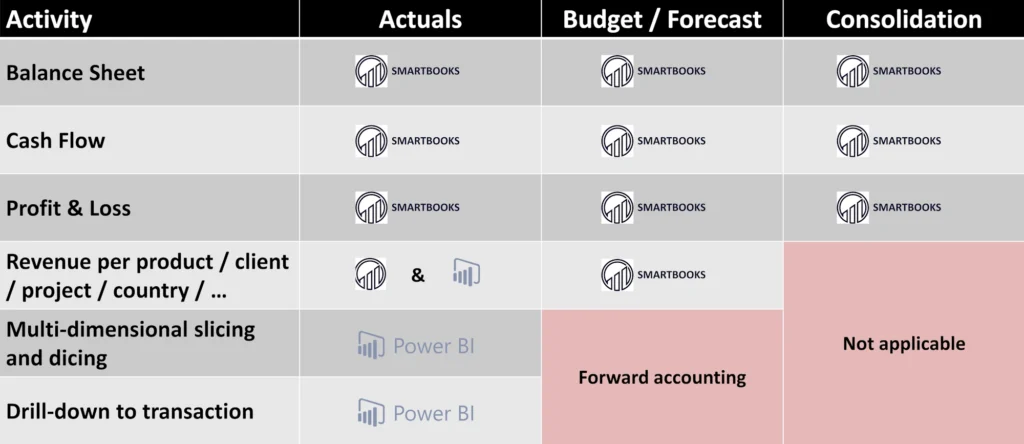

Using both tools side by side enables businesses to leverage their unique capabilities for a more rounded approach to business intelligence. With FP&A tools handling the financial intricacies and PowerBI illuminating operational data, companies can ensure that both their financial and operational strategies are informed, robust, and driven by comprehensive insights. The following table shows the possible use of Smartbooks for different FP&A activities and the specific added value of PowerBI in detailed analytics. Budgeting per product or client may be useful in sales or production planning but is not very common in the finance department.